I'm studying finance and am struggling to find the difference between the macaulay duration and the modified duration?

I believe the Macaulay duration is the effective time a bond is due to be repaid in years using a weighted average of future coupons/cashflows.

The bit I'm struggling with is what the modified duration really shows (I think it somehow relates to interest rates and sensitivity).

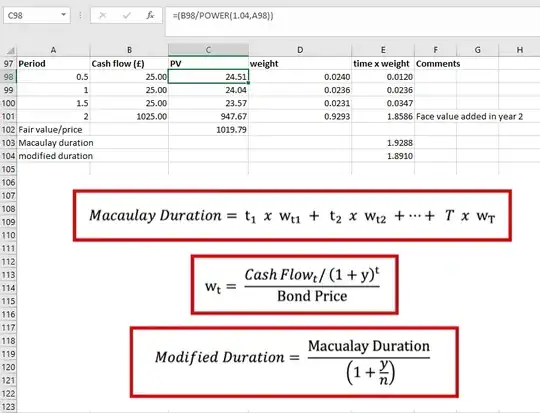

Using an example in the picture below with a 2 year bond that has a face value of £1000 and 2 annual coupons, I understand that the bond will effectively repay its face value in 1.92 years (Macaulay duration). But what does the modified duration tell me? How does 1.89 relate to interest rate and price sensitivity?