If you deposit $1000 into a trading account with 10x leverage, you have $10,000 of purchasing power to buy securities or currencies.

You are borrowing the "margin" money

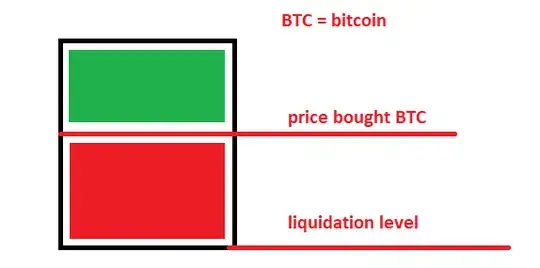

You can buy $10,000 worth of Bitcoin into this account. $1000 of the money will be yours and $9000 will be loaned to you at an interest rate.

If the value of that Bitcoin rises to $20,000, you can sell the bitcoin then, and the sales proceeds will be $20,000. You will pay back the $9000 loan and have $11,000 profit.

If the value of the Bitcoin falls to $5000, and you sell the bitcoin then, you will gross $5000, and you will pay an additional $4000 to settle out the $9000 loan, and be totally wiped out. Except that will not be allowed to happen, because the broker will not trust you to voluntarily pay the additional $4000.

If the value of the Bitcoin falls to $9500, that means that there's $500 of your own money into it, and $9000 of the broker's. There's a big problem: You are now 19x leveraged - you have only $500 of your own cash but $9000 of their cash at risk. That wasn't the agreement!

Margin call

So the trader is going to make a margin call at this point. A margin call requires you to pay $500 additional cash into your account so that to bring your borrowing back to 10x as agreed. You can accomplish that by selling some of the Bitcoin.

If you refuse to do that, they will force sale of some of the Bitcoin. At this money-losing price for you.

So if Bitcoin is going down, down and more down... this would trigger repeated forced sales due to the margin calls. These sales would occur at lower and lower sale prices.

So these margin-call sales are "locking in" your losses.