I was surprised to see that one of my simple and rather small buy limit orders for a stock traded on the NASDAQ got placed under review for 23 seconds before it got executed (small ~= 30kUSD, which represents only 0.01% of the firm's market cap).

https://www.tdameritrade.com/retail-en_us/resources/pdf/SDPS819.pdf (mirror 1, mirror 2) mentions:

Order Review. TD Ameritrade reserves the right to review orders before sending them to the market to ensure they comply with the rules and policies of TD Ameritrade and the securities markets. The order review process may delay the routing of orders to exchanges, market makers, and electronic communication networks (ECNs). If it is determined that processing or executing the order poses an unreasonable risk to our clients or our firm, or that it could disrupt the market or our operations, the order will be refused or rejected.

But this is quite vague. What kind of checks must be done on a simple and small buy limit order "to ensure they comply with the rules and policies of TD Ameritrade and the securities market"?

Also I wonder whether this kind of reviews are manual or automated: 23 seconds is rather fast for manual and extremely slow for automated.

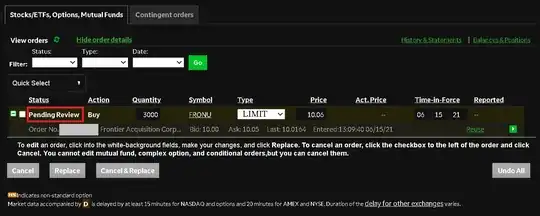

The buy limit order in question: