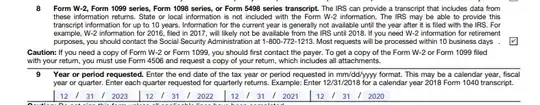

Is there a way to get your 'history' or 'profile' form the IRS. By this I mean, can I find out what has been reported to them about me by third parties over the years in terms of W-4 forms, 1099 forms, etc.?

If I haven't kept good records, can they tell me anything about the returns I've filed over the years?