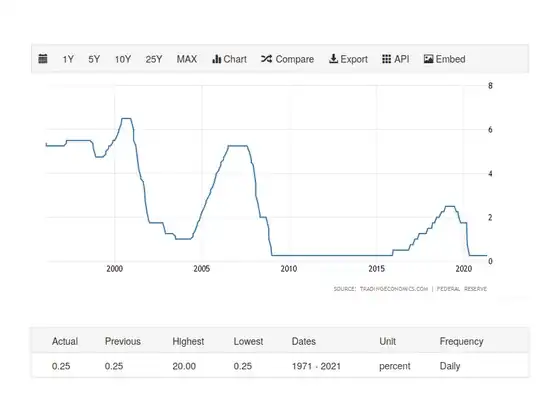

With the COVID crisis the FED has lower interest rates a lot:

Now, inspecting the US yield curve:

It seems to be that this is a normal curve that doesn't flatten too much at the end. Is this correct?

According to this article:

A steep yield curve doesn't flatten out at the end. This suggests a growing economy and, possibly, higher inflation to come.

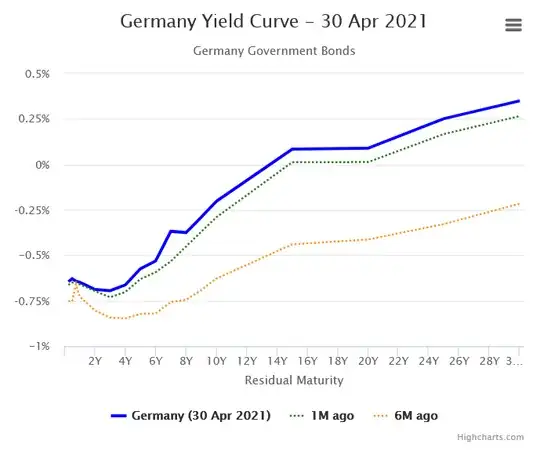

So one could expect inflation to come, however many countries have followed the same strategy as the US. If all these currencies get inflated as well, wouldn't all these inflations cancel out each other?

Other questions:

- Is the steep-up curve explained by the fact that interest rates mostly can't go lower, therefore they can only rise?

- Taking these two curves into account, is there any sensible reason to invest in bonds at this moment? (it seems evident to me that not, but I'm possibly missing some weird behaviour the market could have to justify it)

- If the above is correct, a defensive investor would only invest in bonds if the yield curve is flatter, do you agree?