From my understanding, a security's prices are published by the exchange on which it is trading. How do the exchanges determine what price to publish? Is the displayed price simply the latest fill price, or is it calculated by some other method? (I assume it is not the latest fill price, because if it were, I would not expect a security's price chart to be continuous.)

Asked

Active

Viewed 64 times

1 Answers

3

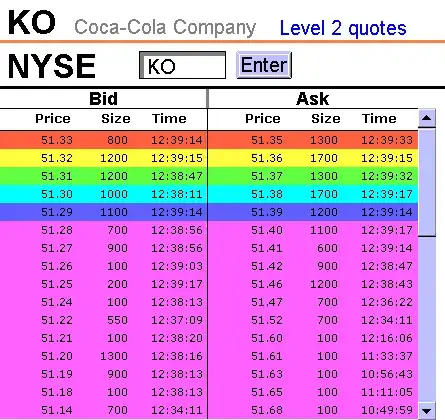

A current quote from the stock exchange includes the following data points:

Bid Price

- The highest posted price someone is willing to buy an asset

Bid Size

- The number of shares or contracts that people are trying to buy at the bid price

Ask Price

- The lowest posted price someone is willing to sell an asset. Also called the "offer price."

Ask Size

- The number of shares or contracts being sold at the ask price

Last Price

- The price at which the last transaction occurred

Last Size

- The number of shares or contracts involved in the last transaction

The market is an auction and there are additional orders at lower bid and higher ask prices on the order book. As orders at current price are taken out, the next order on the order book becomes the new quote, depending on whether price is moving up or it is dropping. An example of this is:

Bob Baerker

- 77,328

- 15

- 101

- 175