My understanding of how GBTC works is that all of the following are true:

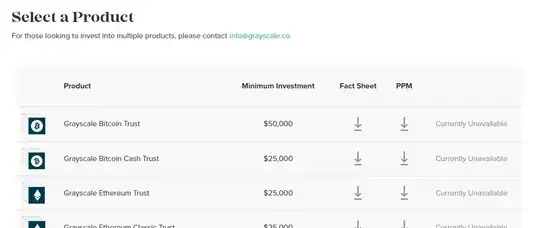

- Accredited investors may provide BTC to Grayscale and receive shares of GBTC in exchange.

- After a six month lockup, the investor who received these shares may sell them on the open market.

- GBTC shares are consistently bought and sold at a premium to their corresponding amount of BTC (typically somewhere between 20 and 35%).

It seems a simple arbitrage opportunity is present. The steps are

- Buy BTC

- Exchange it for GBTC

- After 6 months, sell the GBTC and use the proceeds to buy BTC

- Exchange the BTC for 20-35% more GBTC than you had before.

- Rinse and repeat

Why does this arbitrage opportunity not cause the premium of GBTC to be reduced to 0?

Furthermore, why doesn't Grayscale sell its own shares on the open market and use the money to purchase BTC or to fund its own operations (potentially reducing the need to charge a 2% annual fee), reducing the premium?

(I know GBTC isn't technically an ETF, but using that tag because it's a close approximate)