There is some (unexpected to me) behaviour in a stock which led to me losing quite a bit of money and I would like to understand what is happening.

The stock in question is GraniteShares 3x Short Rolls-Royce Daily ETP (3SRR).

My understanding and expectation is that it would go up when the underlying stock (Rolls-Royce) goes down and down when the underlying goes up.

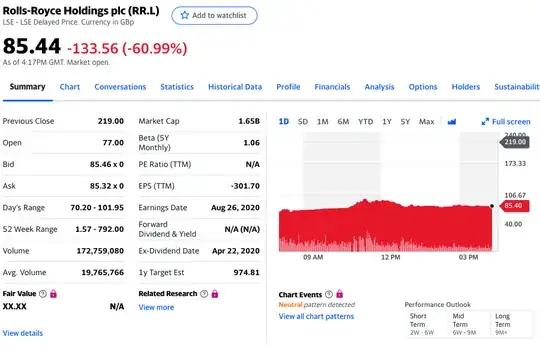

Here is a screenshot of the underlying's performance today from Yahoo! Finance:

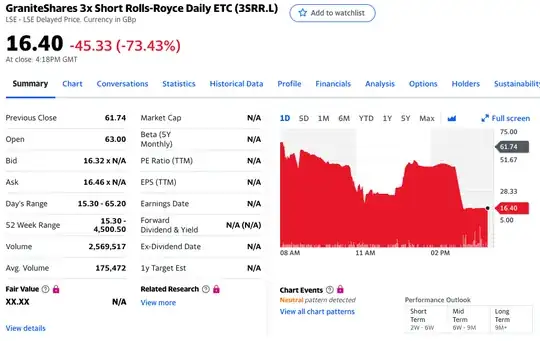

And here is a screenshot of 3SRR's performance today from Yahoo! Finance:

I am guessing this is related to the Rolls-Royce rights issue. Indeed GraniteShares have posted an article about this so it probably is expected but I don't fully understand what's happening here. So I'd like to understand a few things:

- Why is 3SRR going down instead of up when the underlying is going down?

- Why is 3LRR going up by only 38% when 3SRR went down by 73%? I would expect it to be up by much more.

- The price went from about 60p down to about 28p, then within a short time up to about 50p and even quicker down to 16p. Is this simply due to trading activity or something else?