Start as early as possible and you will want to kiss your younger self when you get to retirement age. I know you (and everyone else at that age) thinks that they don't make enough to start saving and leans towards waiting until you get established in your career and start making better money. Don't put it off. Save some money out of each paycheck even if it is only $50.

Trust me, as little as you make now, you probably have more disposable income than you will when you make twice as much. Your lifestyle always seems to keep up with your income and you will likely ALWAYS feel like you don't have money left over to save.

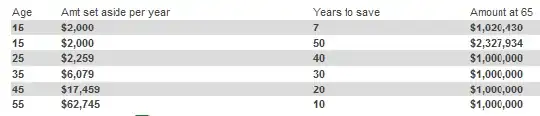

The longer you wait, the more you are going to have to stuff away to make up for that lost time you could have been compounding your returns as shown in this table (assuming 9.4 percent average gain annually, which has been the average return on the stock market from 1926-2010).

I also suggest reading this article when explains it in more detail: Who Wants to be a millionaire?