Your question assumes that all government bonds with a positive yield are more reliable than any company's bonds.

There are some circumstances we should take into account here:

- The best government bonds have a negative yield already (for 10 year bonds this includes Japan, Switzerland, the Netherlands and Germany - currently even France). The bond that was bought in your screenshot has a remaining running time of roughly one year. For bonds with such a short time, even riskier countries like Portugal (-0,39%) or Italy (-0,21%) have a negative yield. (tradingeconomics)

- The safest bond's yield rates converge to the central bank's deposit interest rates. It is important that, if you are looking for "super-safe" investments, you always compare the return with these rates. Currently the ECB is at -0,5%, Swiss central bank at -0,75%, FED at ~0%.

- Most countries currently spend a lot of money to overcome the impacts of Corona (fiscal policy). This increases the level of government's debt and its risk of default. As the level of debt is measured as

total debt / GDP and the gross domestic product of many countries is free-falling due to Covid restrictions.

- There are some companies like Coca-Cola, Google or Apple that have credit-ratings and assumed default risks that are way less than most governments. Also, these companies tend to have no debt at all while countries like Japan, Germany or the US are trillions of dollars in debt.

- The risk of companies might be splitted better than those of governments. Most global operating companies have up to hundreds of branches globally and can compensate political crises better than most countries. The US is heavily dependend on trade but gets blocked by other countries due to Covid. Germany depends on all other Euro-zone countries as they have a common currency. Also, some countries might have wars in the next time, which directly leads to bankruptcy. All countries have neighbours...

- If you want so safely "park" your money, it is important to diversify to reduce your risk. If you just invest in one bond, you may lose all your money if it defaults: It is the right mix that counts!

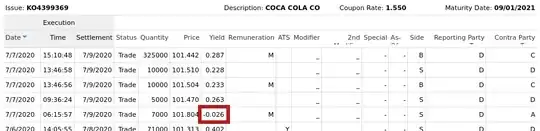

The specific trade you posted looks weird at first glance, but we should consider the circumstances. Coca-Cola Company (CCC) has a great credit-rating and a high level of local value creation. This means, that lockdowns and trade bans between countries have no impact for CCC. As they spread their assets and value-creation across all countries in the world (except Cuba und Iran) they have one of the lowest political risks of all government's and companies.

The trade appears to be made to "park" some money and for the specific investor this appeared as a good opportunity. It is obviously unusual, but considering the argumentation above, it might have been a great decision.