I would like to visually discover how the monthly repayments of a given loan (for a given amount ; taking about a fixed rate loan) evolve in function of the total duration of the loan. I assume it is not a linear diminution, is it ? Same question regarding the cost of the credit. Any idea where I could find this data visualization ? thanks

2 Answers

Have a look this free website: http://www.loanfor.us/ (disclaimer: I am one of the developer behind this site).

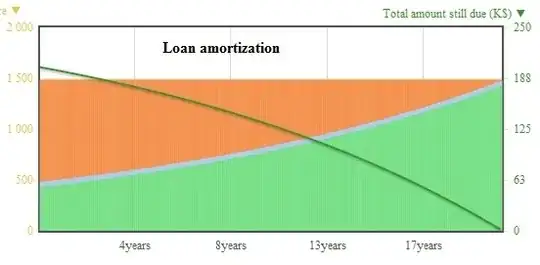

Here you'll get interactive graphs concerning fixed rate loan. For example if you borrow 200.000 dollars with a 20 years term, with a fixed rate of 6%, the monthly repayment is constant and equals to 1.483 dollars / month.

But this constant sum is equals to principal repayment (in green) + interest repayment (in orange) + insurance repayment (constant in light blue). And indeed the curve principal vs. repayment is non-linear.

Btw, the site will shows other interesting graphs, such as:

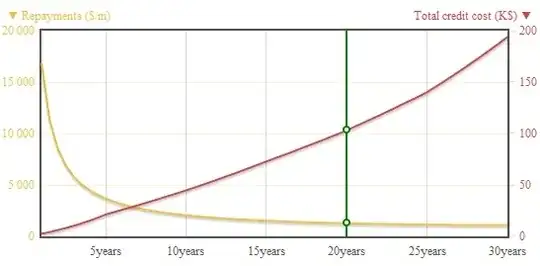

- the total credit cost function of the loan term (in red)

- and the mensual repayment function of the loan term (in yellow)

Nice website, although there are a few issues, that could be added.

- Factor in closing costs

- Comparison between two different options including closing costs

- Factor in tax savings by interest deduction and inflation

Here are some other choices (quick google search, no warranties) http://www.dinkytown.net/java/MortgageRefinance.html http://www.bestmortgage.com/Calc.html

Inflation is actually quite important and frequently overlooked. In the above graph, you can see that the total cost for 30 year looks pretty bad. However, assuming a 3% inflation rate, a $1000 are only $411 dollar in 30 years. So the question is is the "total credit cost" expressed in "today's" dollars in "dollars at the end of the term" or some undefined mixture thereof.

Here is a simple example calculator with inflation: http://ostermiller.org/calc/mortgage.html A 100k/4%/30year mortgage cost $171k total but only $129k in "today's" dollar assuming 2% inflation. If the inflation rate gets higher than the interest rate, you will actually be MAKING money.

- 11

- 1