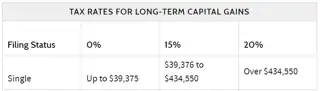

According to Investopedia, people pay varying long-term capital gains tax based on an income-based rate schedule.

It appears that a person with single tax-filing status who earns less than $39,375 (in 2019) and that sells assets held for more than one year would essentially not pay any capital gains tax.

My question: is this $39k limit based on just income from a job or does it also include the capital gains as part of this income?

To help me be sure I understand, could you indicate the tax rate of each of the following single-filing status scenarios?

$36k income on W2 + $4k from selling long-term assets.

$10k income on W2 + $30k from selling long-term assets.

$0 income on W2 + $40k from selling long-term assets.

It seems to me that each of these scenarios would be taxed at the 15% rate, but I'm trying to make sure I understand this correctly.