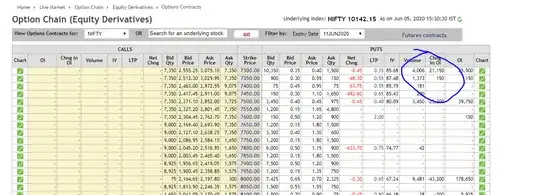

The following is the screenshot of the NIFTY 50 option chain.

It is taken from the following link.

Why are these people buying these significantly out-of-the-money options? In this case, it's the put option of 7300 strike price. It's highly unlikely that the Index will fall more than 500-600 points in this series unless very serious news comes out affecting the entire economy.

Even if the index falls by, let's say, 500 points, the value for that option won't change more than 0.50 or such price.

Specifically, what strategy are these people following where they could possibly benefit from buying such an option?