I saw a tweet from the Chief Investment Strategist of Charles Schwab that said the following:

Since 1993 from @bespokeinvest :

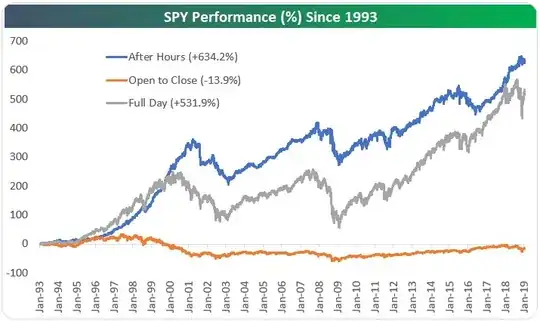

Buying SPY at open & selling at close every day (ie, only holding it during trading day): -13.9% return

Buying SPY at close & selling at next open (ie, only holding it after-hours): +634.2%

It included the following graphic:

Why has the S&P 500 generated such a massive gain since 1993 during the overnight hours (4pm to 9:30am), and has an overall loss during normal trading hours (9:30am to 4pm)?