I am working on bull put spread. Currently the spot is way below both the strike prices. So one strike is deep in the money and other is in the money. Net position delta retrieved from Bloomberg for this strategy is negative. But as per my understanding net delta of bull put spread will always be positive. Is it possible

2 Answers

All else equal, a put with a higher strike will have a more negative delta than a put with a lower strike. If an investor buys a high strike put and sells a low strike put, it is a negative exposure to the underlying.

Options trading can be risky and can cause significant losses. Options trading is not appropriate for some investors. The above is not investment advice and should not be relied upon for an investment decision.

- 2,791

- 10

- 29

It is quick to check with excel or some coding language that this indeed can happen:

import numpy as np

from scipy.stats import norm

def BSM(S,K,r,d,t, sigma, cp_flag):

d1 = ((np.log(S/K) + (r - d + 0.5 * sigma *2) t) / (sigma * np.sqrt (t)))

d2 = d1 - sigma * np.sqrt(t)

opt = cp_flagS norm.cdf(cp_flagd1) - cp_flag K * np.exp(-rt) norm.cdf(cp_flagd2)

delta = cp_flagnp.exp(-dt)norm.cdf(cp_flag*d1)

return opt, delta

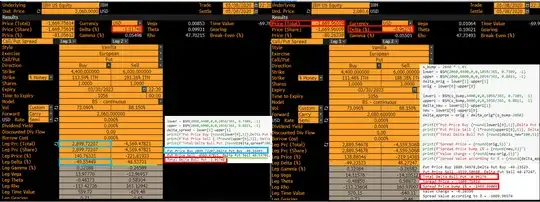

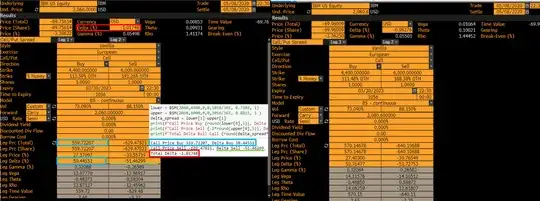

Below is a screenshot from Bloomberg (ignore the underlying, I just manually entered the OPs data and the calculator is simply like a spreadsheet that takes inputs).

This structure has a negative (total) delta. I am convinced that the IV the OP stated was mixed up between the buy and sell position because otherwise it would not be negative. After all, it is the high IV that makes this possible. Also, vol smiles for such far OTM are always increasing. You can for example look at the last figure in this answer to see this.

The figure on the right shows you the option price change of a 1% increase in spot price as the approiximate value based on delta. You see that this is indeed negative.

An interesting side remark is that Bull call and Bull Put spreads have identical deltas, and payoffs at expiry, but a bull put spread is usually an inflow of money up front (credit spread) as the ITM put that you sell is more expensive as the ATM you buy.

Profit is in both cases maximum when the underlying closes above the short strike on expiration. Breakeven however differs in calculation:

- bull call spread: Break even point = Lower strike price + Net premium paid

- bull put spread: Break even point = upper strike price - net premium received

In other words, if below lower strike, and calls, you simply have the costs that are lost. With puts, you have your inflow from selling ITM put minus the loss in the the put you sold (notional*(K_{High}-K_{Low})). Therefore, below lowest strike, you should have upfront cost bull call spread = "income" bull put spread - loss of strategy.

Similar arguments hold for in between and above higher strike.

- 3,059

- 1

- 13

- 34