There are several similar answers, but I feel a need to clarify how stock prices really work.

The original post is about Point 3 below -- someone taking Control of the Company and divesting its assets.

The stock price shown on exchange as current is actually two prices: how much someone is prepared to pay for a "small" number of stocks, and how much someone is willing to sell a "small" number of stocks. The part of "small" is relevant for Point 3 below.

The buyer of a stock is willing to pay for one, two or three things:

- Future dividends (guessing how much the Company will pay in dividends)

- Future change in the stock value (guessing how much other buyers are willing to pay for the stock)

- Control of the Company (often requires buying a lot of shares, hence in getting control there is generally a premium paid above current share price).

Point 3 might be because you want to do a merger, or simply divest the companies assets, or any other reason. Control requires a large part, often at least 50%, of the votes for the shares (note that in some countries different types of shares can have different voting rights). There are in many markets a minority shareholder protection, say if other shareholders has above 10% to complicate matters a bit more.

(Of course, for an individual sale there can be further reasons. Not unusual is to realize a profit / loss in order to influence taxes).

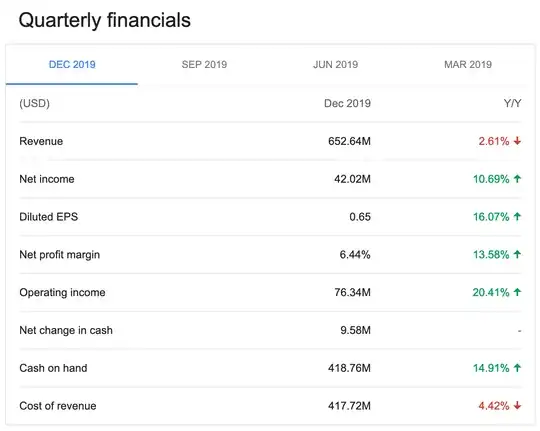

but the last earnings report shows 418.76M$ "cash on hand".

but the last earnings report shows 418.76M$ "cash on hand".