I recently came across an article that made me think about marginal tax rates in the US. Specifically, in the fourth paragraph there is the statement:

He once asked me to explain to her that if she would cut her salary by almost a third, she would earn exactly the same amount per picture (in a lower tax bracket) and MGM would enjoy the savings.

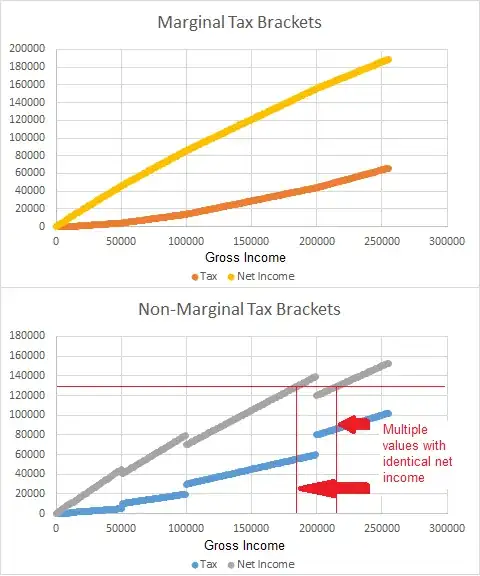

My first thought was that this was not possible and a result of the (fairly common) misunderstanding of the way marginal tax rates are applied. Seeing as this advice was given to Greta Garbo in her prime, though, I wondered if the marginal-rate type of taxation that I'm now familiar with has always been the case in the US and that this anecdote is just a historical anomaly.

My questions are:

- Has the US always used a marginal-tax system for income tax, as is the current practice?

- Is it mathematically possible that, under a marginal-tax system as is the current standard, the quoted statement could be true? (I do not think so, but I can't exhaustively prove it.)