When the question was asked, it seems FT used Bloomberg data for the link. It is now using Refinitiv.

€STR is an OIS swap, which stands for overnight index swap. RFR (risk free rate) is the current acronym ISDA, central banks and regulators use for the indices in IBOR transition.

EUSA10 is the ticker for a 6m Euribor swap, which still trade frequently and Euribor is not scheduled to be discountinued (see for example the recommendations by the working group on

euro risk-free rates). It is a fixed to float interest rate swap that has 6m Euribor as the reference index.

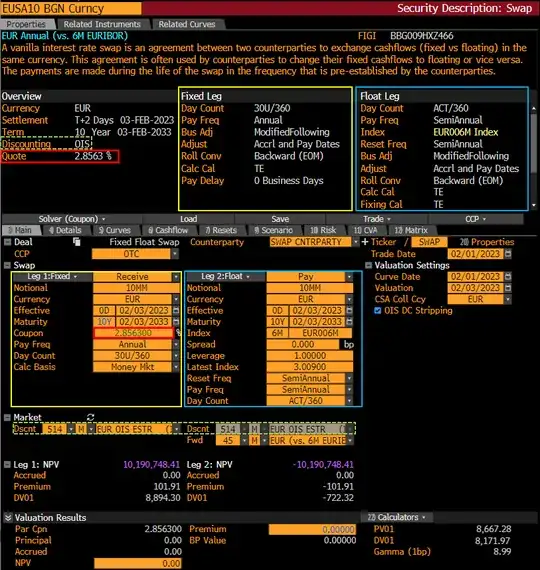

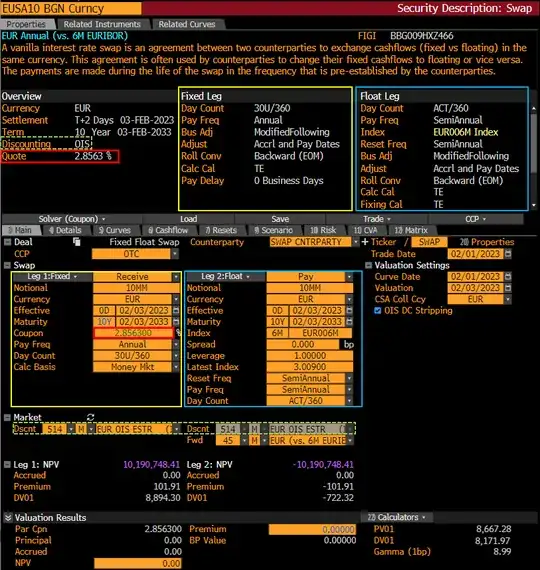

Below is a screenshot of the DES page of the ticker EUSA10 and the associated swap pricer SWPM.

As you can see, the NPV of both legs matches, making the swap zero cost at initiation. The market quote at the top is a generic quote (BGN) that Bloomberg computes from all available quotes that Bloomberg currently receives. This generic is the basis for the SWPM screen (unless you select a different market maker as your choice within the market data section).

The OIS discounting is unrelated to the swap legs, which are fixed vs 6m Euribor. It is standard to have so called dual curve stripping, meaning standard swap cash flows are discounted using OIS rates (now €STR for EUR).

Edit

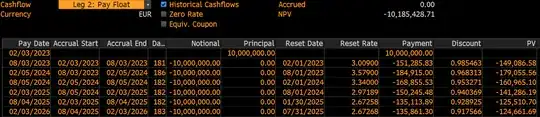

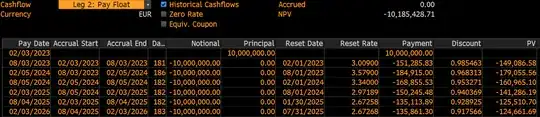

In my example above, accrual start is 02/03/2023 (the effective date) and the first period ends in 08/03/2023 which is the pay date. The rate is set on 02/01/2023 (which is the latest index). The next period is from 08/03/2023 until 02/05/2024 with pay date on 02/05/2024, and reset on 08/01/2023. That is because reset is in advance for these swaps (SOFR or ESTR swaps would be in Arrears) and the number of days before accrual are by default 2.

The swap curve is used prior to observing the actual reset values. On the dates itself, the fixing is observed and the actual cashflow is determined.