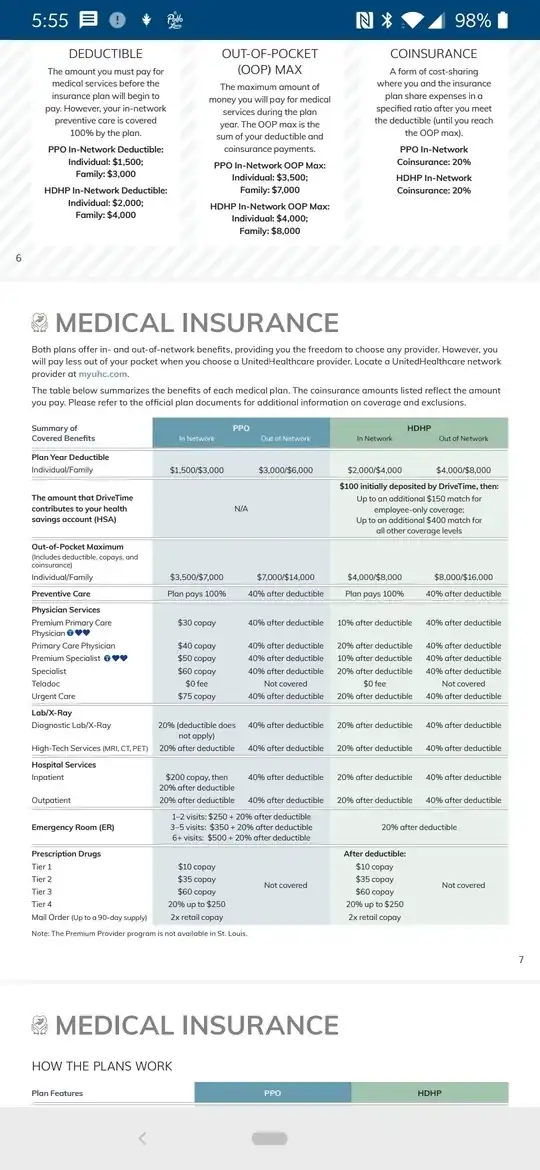

My employer offers two health plans:

- PPO with optional FSA

- HDHP (high deductible health plan) with an HSA option.

The plans have identical coverage, the difference is in the premiums, deductibles, and oop (out-of-pocket) maxes. The PPO has a deductable of 2k individual, 4k family and an oop max of 4k individual and 8k family.

I am in the process of running the numbers, but so far it is looking like I am going with the PPO plan, after having been on some form of HDHP for the last decade.

If I do go with the PPO plan, am I allowed to open my own HSA (like the one with Fidelity: https://www.fidelity.com/go/hsa/why-hsa for example), since the deductable and OOP max is within the IRS rules for HSA eligibility? Here is the IRS publication: https://www.irs.gov/publications/p969