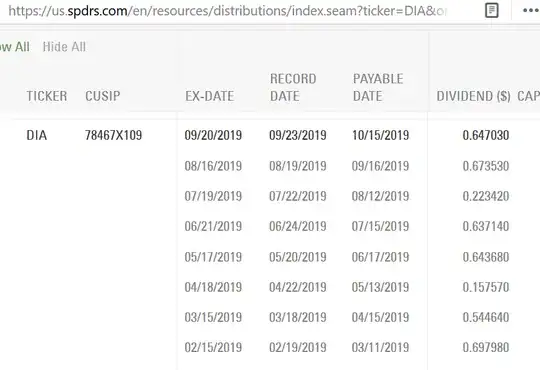

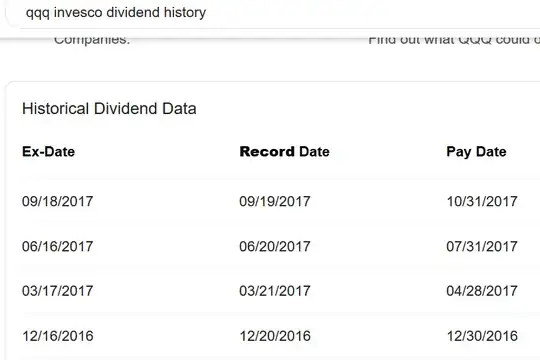

I was looking at ETFs and noticed that etf like QQQ, DIA( Ex date is 09/20/2019 but pay date is 10/15/2019) pay dividends about 5 to 6 weeks after the Ex-Dividend date . But other etfs (e.g IVV, VOO) pay dividend in less than 1 week after the ex -dividend date. Please see screenshots below.

My Question is why is that? Why some ETF companies are holding the money for 5-6 weeks, but others are able to pay with in a week?

Note: This question is simply asking what is the logic( reason) behind such delay ( by some etf)or not delay (by some etf) in paying the dividend. No one is asking suggestion if one should chose what kind of ETF, rate of return. No one is asking that ETF value goes by the dividend amount etc. And even in same ETF category like S&P 500 some ETFs are paying in 1 weeks( VOO and IVV) and some are paying in 5-6 weeks (SPY).