Assumptions (using round numbers):

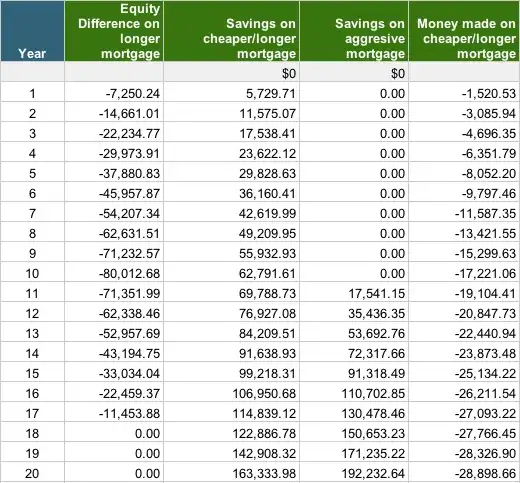

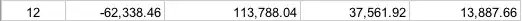

- Two children start college in 12 and 15 years.

- Currently saving $400/month in a college savings fund earning ~2%. (Some in a taxable account, some in a Coverdell.)

- $150k mortgage at 4% with a $1k/mo payment and 18 years to payoff.

- I can refi into a 10 year fixed-rate mortgage at 3% with a $1400/mo payment.

- I'm never going to move out of this house.

- Retirement and other savings/debt are taken care of and are outside the scope of this decision.

Staying with the current mortgage/savings scheme would mean $53k in the savings fund after 12 years, but a ~$80k balance on the mortgage at that time, and only the $5k/year of cash from the monthly savings deposit to add to it. This is $35k of cash flow during the 7 years of college attendance for both kids. Net cash available for college is $88k (53 + 35).

After the mortgage is paid off, I'd have two years to put that $1400/mo into a savings account -- $34k. A paid-off mortgage also means ~$17k/year of cash (from the former mortgage payment) during college years. Over 7 years of college attendance, this is ~$117k in cash flow. So it looks like this nets $151k (34 + 117) through the end of college attendance.

The 10y mortgage option looks really attractive.

Is there anything I'm missing in this analysis that makes the 10y refi a bad idea?