Just reading through Charles Schwab's margin brochure and saw this section...

The securities used as collateral must maintain a minimum value relative to the account’s margin debit balance. Schwab’s basic maintenance requirement for equity securities (“stock”) is 30% of the current market value of the security; however, this varies depending on the type of security.

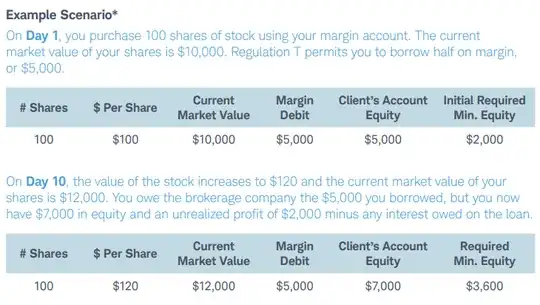

So we see that the min. req. is based on the total value of the securities in the account that were purchased in any part on margin (I'm assuming this is the case meant to be illustrated here and not that that it's based on the total market value of the account (though my question would still make sense in both cases)), eg. 30% of $12k is $3.6k.

My question is: what is the logic of having the min. reqs. be based on the total equity value of the securities that have some margin money used in them and not just the value of the actual margin debt?

Because from this it seems like if you bought $100k worth of stock and $1k of that was bought on margin, then the min. req. is going to be $100k x 0.3 = $30k, which seems odd relative to the amount borrowed. Am I misinterpreting something here? Do let me know. Never used margin and don't know which way would be better or worse, just curious.