Today, I only bought groceries at Walmart and noticed that there is no tax on groceries in California (Google tells me that this is perhaps true for whole of the US?)

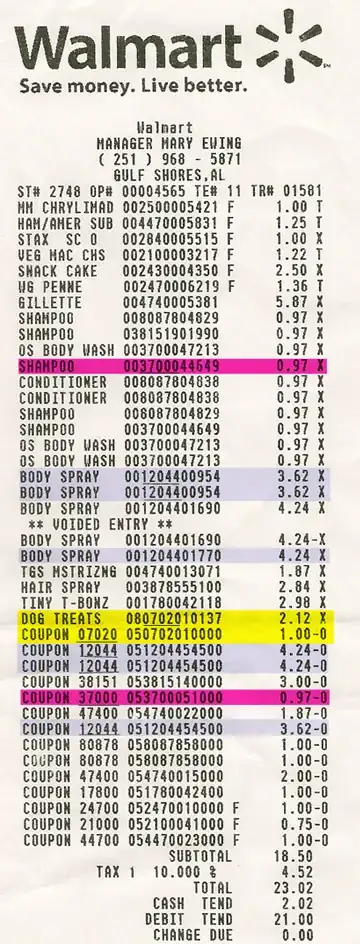

So far I have always paid tax at Walmart for my grocery purchases, but that also included items like crackers, shampoo etc

Did Walmart charge me then only for the items that were not groceries, or if your cart has groceries + non-grocery items, you get charged tax on all of them?

Or is this a policy that varies by store, or cashiers' knowledge/discretion, etc?

Would people recommend for me to break down a single mixed purchase into two: one only having groceries and the other with the rest, or is this being paranoid?

My grocery purchases, every two weeks, amount to around $100+. I pay 8.25% tax, so that is enough to get me free gas if I can figure this out!