The Goods and Services Tax (GST) is a destination based tax, which means that the state in which the goods are consumed receives the tax. The GST is implemented using three separate taxes:

- Central Goods and Services Tax (CGST)

- State Goods and Services Tax (SGST)

- Integrated Goods and Services Tax (IGST)

The first two taxes are levied on intra-state transactions while the third one is levied on inter-state transactions. Together, these three taxes ensure that the state in which the goods are consumed, receive the tax.

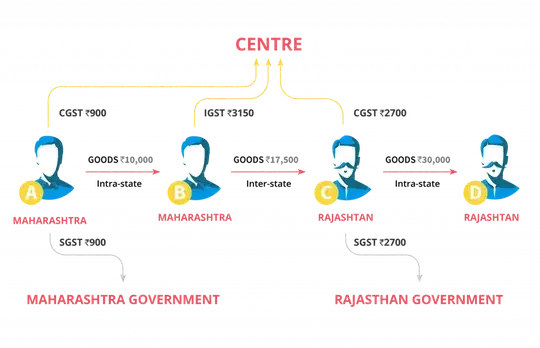

The following article gives us an example:

Here, there are three transactions:

- Person A sells goods to B within Maharashtra for ₹10,000 (with tax ₹11,800).

- Central government receives ₹900 tax (CGST).

- Maharashtra government receives ₹900 tax (SGST).

- Person B sells the same goods to C who is in Rajasthan for ₹17,500 (with tax ₹20,650).

- Central government receives ₹3,150 tax (IGST).

- Person C sells the same goods to D within Rajasthan for ₹30,000 (with tax ₹35,400).

- Central government receives ₹2,700 tax (CGST).

- Rajasthan government receives ₹2,700 tax (SGST).

Hence, in the end, ₹10,350 was collected in tax:

- Central government got ₹6,750 in tax (₹900 + ₹3,150 + ₹2,700).

- Maharashtra government got ₹900 in tax.

- Rajasthan government got ₹2,700 in tax.

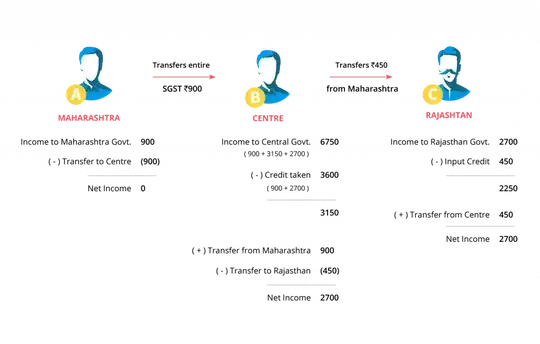

Now, according to GST, only the central government and Rajasthan should get tax. Hence, I believe that ₹10,350 should be split between the two (i.e. the central government gets ₹5,175 and Rajasthan government gets ₹5,175). However, this is not what happens. According to the article, here's what would happen:

Maharashtra sends ₹900 to the central government. This is the only thing that makes sense to me. Here's what doesn't make sense to me:

- The above pictures debits ₹3,600 from the central government columns as “Credit taken”. Where does this money go? Why isn't in included in the net income of the central government?

- Why does the Rajasthan government have to pay ₹450 as “Input Credit”?

- At the end, the total net income is ₹5,400 (the central government gets ₹2,700 and the Rajasthan government gets ₹2,700). What happened to the rest of the ₹4,950 (i.e. ₹900 + ₹3,150 + ₹900)?

Also, could somebody explain to me the entire process of redistributing tax money, step-by-step?