I am about to begin receiving a weekly allowance from my dad. As I am not great at controlling my "buy buy buy now" impulses, could you guys help me put together a savings plan for my allowance, given that I want to save a lot, but not all, of my money for college and beyond. A plan from you guys would really help me control my spending on video games and the like. I am currently entering middle school, if that helps at all.

6 Answers

This is a great question. Kudos to you for recognizing that you want to make a change.

The secret to saving is to have a goal in mind. Saving money for the future is great, but unless you have a goal or purpose for that money that is accumulating, it is too easy to raid it when the next game comes out.

College is a very worthwhile goal, however, there are a couple of issues that make it a challenging goal. First, it is a relatively long ways off, as you won’t be in college for another 4-5 years. Second, you most likely don’t know how much college is going to cost, so it is hard to put a number on that goal. Still, it is an important goal, so we don’t want to forget it altogether.

Here is what I recommend: when you get your allowance, divide it up into three categories: Giving, Saving, and Spending. The money you allocate for Giving is for you to give away to someone or something you care about. You might give it to your church, a charity you care about, or someone you run across who is in need. Don’t skip this. Giving is an important habit to learn early in life. It will make you feel good and will help curb the impulses that are causing you to “buy buy buy now.”

The Saving portion is the money you are setting aside for the future (college). I recommend that you open a bank or credit union account and deposit this money there every week. By doing this, you’ll get that money out of the house, making it a little harder to raid if you have a weak moment when the next Pokémon game arrives.

Finally, the remaining portion of your allowance will be designated as “Spending.” This is for you to spend however you want! This is an important part, too. The money here will allow you to buy things you want without raiding the money earmarked for your college savings. You can do whatever you want with it: spend it on snacks, a gift for a friend, a new shirt, etc. However, if you spend this money too quickly, you may not have enough cash when Super Mario Maker 2 hits the shelves in June. So you may want to split this category up further. Set aside some cash in an envelope each week for the next game you are looking forward to, and put the rest in your wallet for spending cash.

The amounts that you put into the three categories are up to you. As a starting point, I recommend 10% into Giving, 50% into Saving, and 40% into Spending. By doing this now, you will get in the habit of budgeting your income, which will serve you well as you get older and both your income and your expenses increase.

- 116,785

- 31

- 330

- 429

Learn how to use spreadsheet programs.

Numbers are hard to think about. If you can visualize them, or see the effects of your plan without having to think, it's easier to make good decisions.

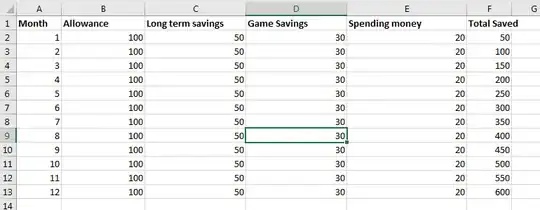

For example, let's assume: You're making $100/month. A high-value video game costs about $60. A mediocre Steam game costs $10. So let's spitball an initial plan and say you want to save half your allowance, and you're okay buying a new "good" game every 2 months. A simple version of your spreadsheet might look like this (though you can definitely get fancier):

And with this plan you could save up $600/year. Are you happy with that number? If not, you can look at the other columns to figure out how to change that. Maybe after a month, you realize that you can get by with less spending money than you thought. Maybe it's a bad year for games and you'd be okay with only getting 4 of the good ones. You can make these changes in your spreadsheet and immediately see the change in your total savings.

You're the only who can decide the best way to spend your money, but a budget like this can help you think about what you really value and see if what you do aligns with what you really want.

As others have said, make sure your savings goes into someplace hard to access if you're having trouble saving it. A savings account is good. Once you've saved enough, maybe you can buy a CD, which earns you a bit more interest.

- 463

- 3

- 8

Congratulations on being this foresighted.

Being that you're in middle school, your allowance won't be that high.

Thus, I suggest that you ask a parent to help you open a fee-free "kids checking account" at their bank, and an online savings account at a bank like Ally (which pays a noticeable interest rate). You'll be able to see your money grow.

This way, you can ask your parent to give you a portion (half sounds good) of your allowance in cash, and automatically transfer the rest into your new savings account.

You'll have a debit card and the ability to transfer money between accounts, but the effort will be enough to hopefully make you think first and act second.

These are only aids, though. The bottom line is that you must WANT to control your "buy buy buy now" impulses. This isn't an "I want a cookie" want, but a deep desire want.

Hope that helps.

- 50,786

- 10

- 107

- 170

When my kids were your age I put their allowance directly into the bank. The bank has special accounts for kids, with no fees.

Each of them also had a savings account (from birth, good for that cash from Grandma), and I arranged for a portion of their monthly allowance to be transferred there. This was really just to show how it works. But when it was time for driving licences and so on, they had the cash there waiting for them.

Once my son wanted to borrow money from me, and I was quite annoyed; "where is your allowance? You just got it"

"My account is empty."

"How can that be? Where's it gone?"

"Invested in bonds at 6% for 12 months. The lady in the bank suggested it."

"Good lad!"

What helped for me was:

- Measure

Every time, when you buy something expensive, record it in a spreadsheet or even simple notebook. For every purchase, assign a category: going out with friends, clothes, games, electronic devices, sport equipment etc.

- Analyze

After regular periods of time make summaries. For you, It will be convenient to adjust it along with days when you receive allowances from your dad. Analyze in what categories you spend most money. Let then imagine consequences of not spending or spending less money into some category.

For instance, when your friends call for you to go out with them (I mean to make purchases, to eat outside, go to cinemas, etc), imagine what social consequences it can cause if you refuse too often. Or maybe you don't consider it as a problem because you are aware that only true friendship remain after being separated across different colleges?

Or for instance consider buying cheaper clothes. Do your girlfriend reject you claiming she won't be with a poor haggard not wearing original Reebook nor Adidas? Or maybe she would understand and be supportive for your long term plans and cheaper shoes would be really enough?

You can also search for totally different alternatives. Consider for instance change your habits. Play more physical activities instead electronic games. Learn how to cook yourself instead of eating out etc...

- Planning

After some of first "sprints" let begin plan your expenses. Let assume in advance what amount of money you consider spending for each category. Please review your plan if is really feasible (at the beginning it might be too ambitious, I mean: zero expenses for games, equipment etc... but "nowadays Steve Jobs" is already waiting to announce new i-pad! It will be too difficult to resist the temptation)

Good psychological trick, would be to share your plan with someone close to you. Your mother, said father, sister, girlfriend etc... During the next planning, share your results. You will be subconsciously afraid of admitting in front of them that you broke your commitment.

- Next iterations

The serious thing starts just here. If you didn't manage to stick to your previous plan, make "retrospections" what was the cause. An unexpected expense? Your best friend organised field trip on holidays? Consider some minimal budget for unexpected expenses in future plans.

On the other hand, if you spent less than expected for some categories, congratulation! Let now consider some budget cuts in future plans.

- 131

- 4

I'm going to paraphrase the most important lesson I learned from a book I read when I was your age called The Richest Man in Babylon.

Pay yourself. Whenever you buy something you're paying other people. When you save and invest, you're paying yourself. If you receive $100, either as an allowance or from work, you were paid. But if you run around handing out $60 for a video game, $10 for download content on the game, and $30 for a new mouse, you just paid everyone else and left nothing for yourself.

The idea of paying myself first shaped my relationship with working, spending and investing. Later in life, I came to the next strong realization that money gives you control in decision making.

I'm sure times have changed but my "trick" to stem spending was to hold the thing I wanted to buy for 10 minutes. I'm in a store, I want a thing, new grips for my BMX bike or something like that. Most of the time, I would get bored and lose interest, the excitement for something new wanes and you're just wandering around with this thing that's way less cool than when you originally saw it. This was particularly effective in learning the difference between a want and a need. I learned that the whole shopping endeavor between buying cool new grips versus a new innertube or flat patch kit was very different. I'd see the cool new thing and want it because it was cool and new, price wasn't an early concern in the process. But inner tubes, I only cared about the price, "want" wasn't even in the equation. Really, I didn't even want the patch kit, but I wanted to ride the bike, so I needed the patch kit. Cool and new fades and it fades quickly.

I'd imagine that it's much more difficult to implement a process like this in the era of online purchases but the idea is to not make purchases out of impulse.

As far as savings vehicles, at your age I had an envelope with a folded up sheet of paper that acted as my bank and ledger stored in a silly overly elaborate hiding place in my room. To me, having a tangible, visual representation of the growth of your savings is important. Feeling the stack of money get thicker over time is more satisfying that a number changing incrementally. In fact, I keep a lock box still with cash in it at home, because I still have that attachment to physical currency. Sure, you won't make any interest income, but a high yield savings account at 2.2% will make $2.22 per year per $100. Your savings is going to grow primarily from contributions and not spending.

Good luck! By even asking this question you are way ahead of your peers I'm sure.

- 49,074

- 11

- 101

- 161