I see I am saving more when I choose Itemized deduction, even though its less than standard deduction. Is that normal? And in this case should I choose itemized and disregard recommendation of Turbo Tax? Screenshots below.

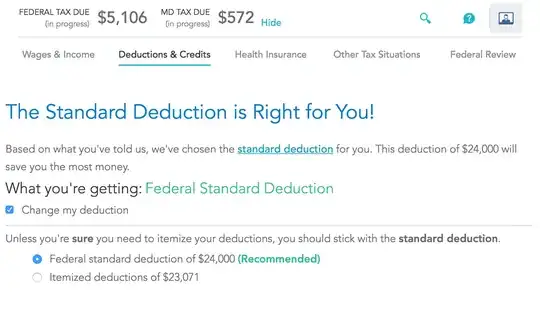

- When I choose Standard Deduction.

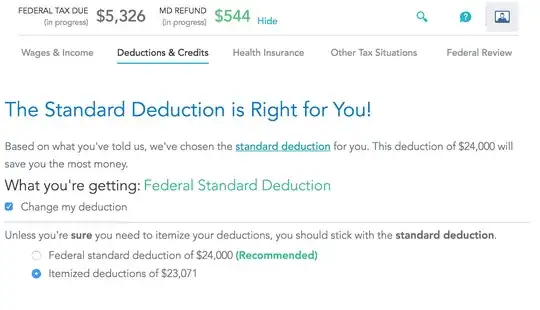

- When I choose Itemized Deduction.