When you take a loan, there will be some interest rate in percent in your contract, and there will be some more or less "interesting" (or confusing, or misleading) rules how the interest payments are to be calculated. These rules would make it possible to give you a deal that is worse than it looks. Or much worse than it looks.

That's why APR was invented. APR takes into account the loan and all the payments that are made, and calculates a fair and mathematically sound interest rate. No matter what tricks the company giving the loan tries to use, APR lets you compare loans. A loan with 20% APR is a better deal than one with 21% APR, and worse than 19% APR and so on.

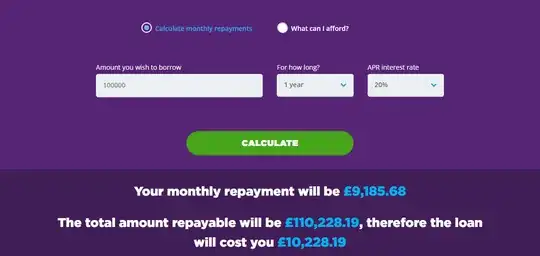

In your case, if you take a loan for one year, paid back in equal monthly payments, and the total payment is £110,228, so your interest payments are 10.228% of the original loans, then a fairly and mathematical sound calculation gives you 20% APR. The reason for the huge difference is that you owed £100,000 in the first month, but less than £10,000 in the last month, so you ought to pay 20% of £100,000 interest in the first month (divided by 12, obviously) but only 20% of £10,000 interest in the last month (again divided by 12).

Actually, I was present when a relative tried to get a loan for a car. (A few years ago, when interest rate was a lot higher). 5 years, 10%. That's what they said, that's what she would have signed. I checked the monthly payments, and it meant £12,000 were paid back for an £8,000 loan. Which meant the interest payment was 10% per year of the original loan. The APR was close to 20%, which they conveniently forgot to mention. I stopped the deal, and should have called Trading Standards. Thieving scumbags. They tried to scam her out of about £2,500.

Whenever you try to get a loan, insist on getting the APR in writing, and that's the real number that counts. Since giving the correct APR is a legal requirement in most countries, giving an incorrectly calculated APR will get them into deep legal trouble. Not if it's 20.1% vs. 20%, but if it's 20.1% vs. 10%.