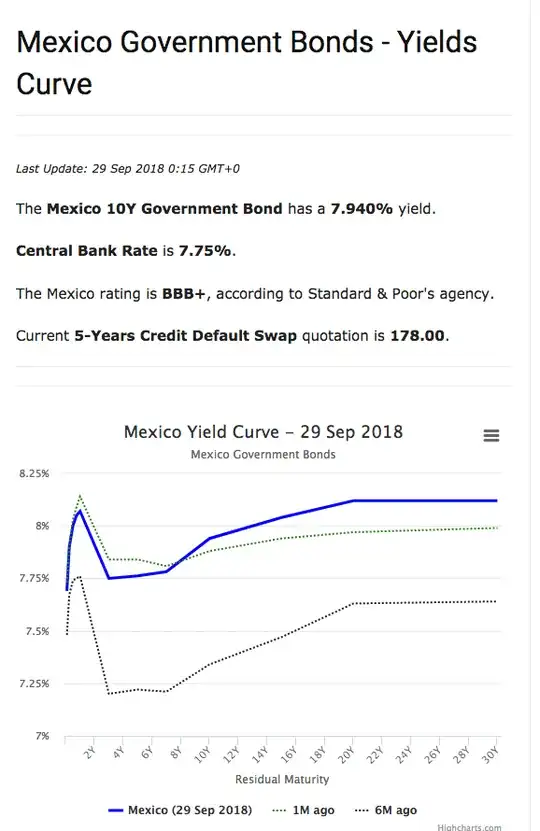

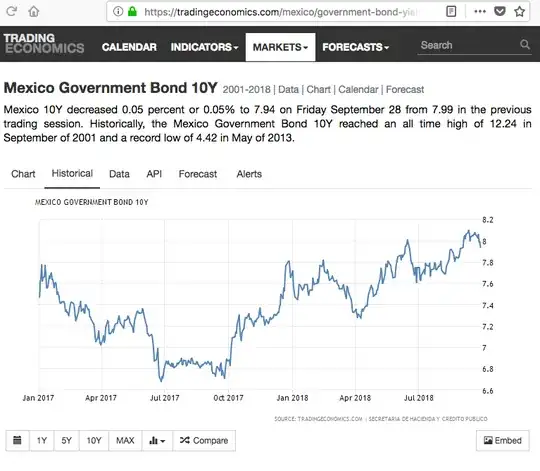

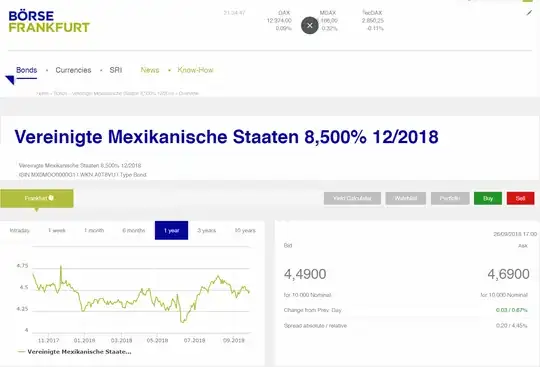

All bonds issued by Mexico with maturity scheduled for 2018 are traded at a huge discount of their face value. I mean whatever currency or stock exchange used here’s an example :

For reference, they are traded at only ¼ of Venezualian bonds discount value which is rated as being on selective default.

This situation seems to be ongoing since the 2000s when the bonds where issued. What can explain such future default since the bonds where all issed after 1982 ?