The 16th Amendment to the Constitution says:

"The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration."

Congress has exercised that power and the main controlling law is in the United States Code, Title 26, Subtitle A, Chapter 1, Subchapter A, Part I - Tax on Individuals.

You can read it yourself at:

US Tax Code

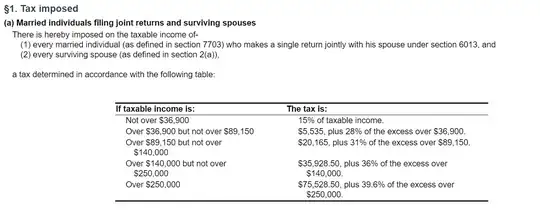

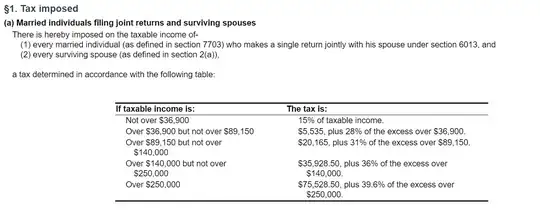

There are multiple possibilities based on your situation, which you did not specify, but, for example there is this:

As far as mandatory, vs. voluntary, the code also gives the Internal Revenue Service the power and authority to enforce the Internal Revenue Code:

26 U.S. Code § 7608 - Authority of internal revenue enforcement officers

It also has numerous sections on the penalties for failing to obey the code, which I will not quote here, but which you can easily find for yourself.

So in answer to your question:

- The US Constitution gives Congress the power to levy income taxes on individuals.

- The USC lists specific taxes and amounts levied.

- The USC gives the IRS the power to enforce the Internal Revenue Code.

- The USC provides for specific fines and other remedies for violaters.