Context: I purchased some land and paid cash for it in full and owned it without any kind of lien. We then proceeded to begin the process of building a house. Secured a builder and a construction loan. As part of construction loan, we used the property as security for the loan. Due to the economic situation and rocket-ship-like rising mortgage rates, we backed out of the project and paid off the loan. We received this today from our bank. I know little law jargon, but it sounds like we are giving the bank our property. That doesn't make sense to me though. Can someone kindly explain this document to me?

1 Answers

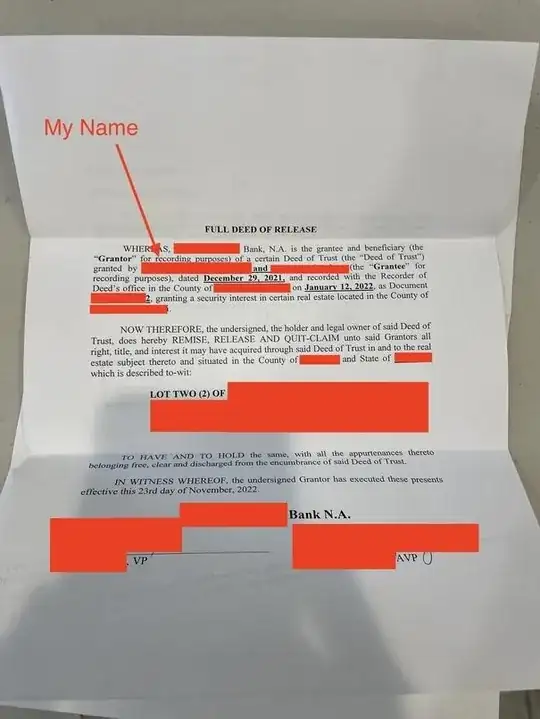

The document involves the bank cancelling the deed of trust (i.e. basically the mortgage) that you gave to the bank for the loan, because it was paid in full.

In a deed of trust, the legal fiction is that you transfer the property to a trustee for the benefit of the bank. The bank was a grantee of an equitable interest in the property and a beneficiary of the trustee of the deed of trust.

You were the grantor in the original transaction, giving the property to the trustee of the deed of trust, in which the bank and the trustee were grantees.

Now, the bank is the grantor giving back to you what you gave up when the deed of trust was created, and you are the grantee of the rights that the bank acquired under the deed of trust.

This is a routine document with nothing that seems to be amiss or needs to be clarified. It just means that the deed of trust is gone and that the property is now free and clear again. Depending upon local real estate practice, it may need to be recorded to establish that fact in the public record.

- 257,510

- 16

- 506

- 896