Delaware Corp (for jurisdiction)

Got involved in an unfunded startup last year and we managed to strike pay dirt. I'm the engineering side of the equation. Got a request to return some of my shares yesterday because of the first round of financing.

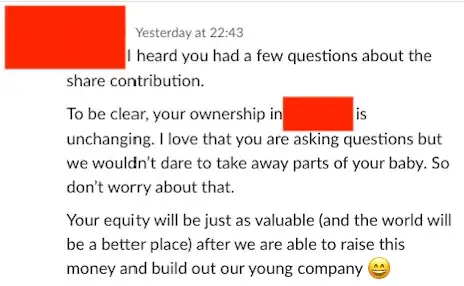

What seems off is that there is no explanation (in the document they want signed) saying this:

As an engineer, I would expect the "outside" assurances to be part of the document. Is that normal? Seems like the intent of the transfer should be expressed in the transfer doc. The assurance that my 3% is unchanging isn't stated anywhere in the document and the reason for doing this isn't stated in the document either. Based on current valuations, this transfer of shares is worth about $127,000. Based on our current trajectory, this could have a zero or two added to the end of it in the next year.

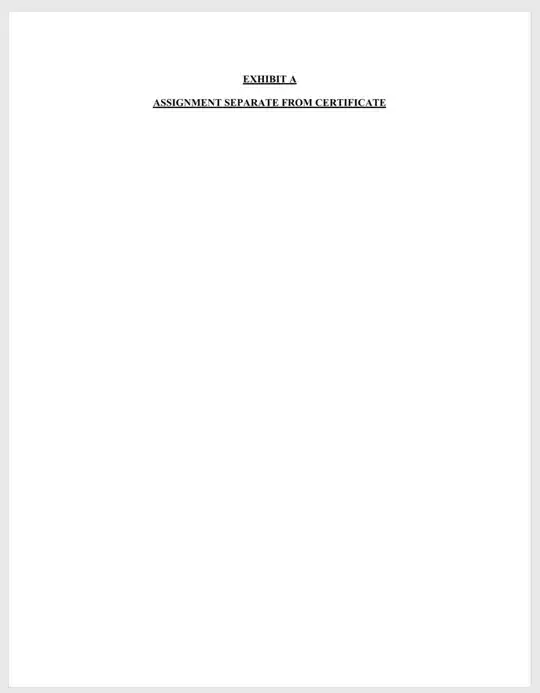

The 2nd thing that bothers me is the blank page:

Blank page reads like a blank check to me and it is followed by this signature page.

So, 4 questions:

- Is this normal or am I suspicious for good cause?

- Shouldn't the reason for the transfer be in the document? (And shouldn't it be expressed as percentage ownership as of this date?)

- Why the blank page?

- What "VALUE" am I receiving for this? No money is changing hands.

I realize that as investors come on they can issue new shares and my percentage will decline, but this isn't a watering down, this is a refund of shares issued.