I read about one of the largest payday loan scammers in the United States of America being caught and eventually found guilty. The case was interesting because the company tried to avoid state law by incorporating on an Indian Reserve, theoretically meaning they would only have to comply with Federal law. Although, this did not help them in court.

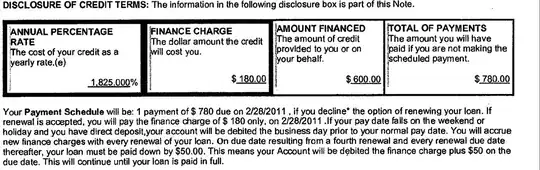

I was hoping, given the publicity, someone could point me to a source because I have since lost the article. In particular, I am interested in reading the misleading contract that clients signed when taking out the payday loan, which caused them to repay more money than they had initially thought.