If I ask the trustees of a trust to confirm that I am a beneficiary, (which is what I believe to be the case), do they have to give an honest answer?

2 Answers

Trustees must be honest with the beneficiaries

It is well established that, in common law, fiduciaries owe their principal duties of honesty, loyalty, and good faith. Lord Justice Millett defined a fiduciary as:

someone who has undertaken to act for or on behalf of another in a particular manner in circumstances which give rise to a relationship of trust and confidence ... [with] the obligation of loyalty

Clearly, trustees are fiduciaries under this definition with the beneficiaries as their principals. If a trustee were to lie or withhold information from a beneficiary regarding their interest in the trust property, they would be in breach of their duty to be honest.

- 6,468

- 1

- 21

- 80

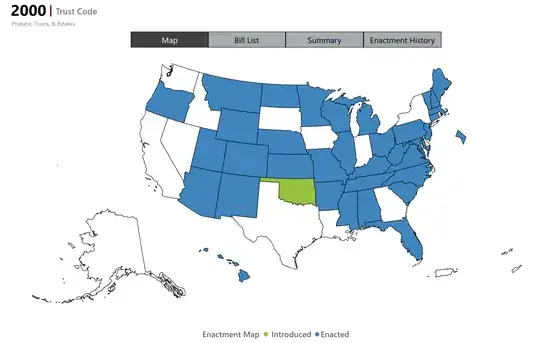

In the many U.S. states which have adopted the Uniform Trust Code, the answer is that yes, this must be disclosed to the beneficiary.

The map is as of 2025. The year 2000 is the date that the Uniform Trust Code's language was finalized. Some states may vary their language and section numbering from the uniform version.

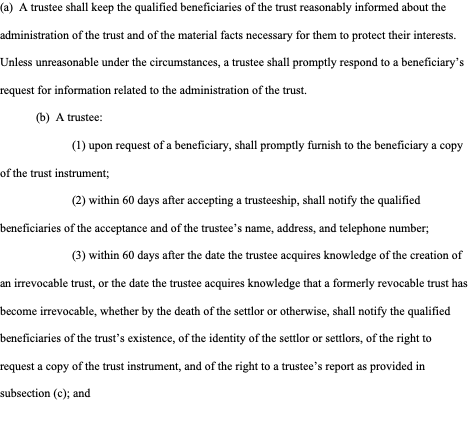

Section 813 of the Uniform Trust Code provides, in the pertinent part:

The Uniform Trust Code is primarily a codification of the common law, although it does deviate from the common law in select respects, so most of the U.S. states that have not adopted it would still have the same rule. The common law background, especially the Restatement (Second) of Trusts § 173, comment c (1959), is reviewed in the official comments to this section. Section 173 of the Restatement (Second) of Trusts says:

The trustee is under a duty to the beneficiary to give him upon his request at reasonable times complete and accurate information as to the nature and amount of the trust property, and to permit him or a person duly authorized by him to inspect the subject matter of the trust and the accounts and vouchers and other documents relating to the trust.

and comment c to that section states in the pertinent part:

[Even though] the terms of the trust may regulate the amount of information which the trustee must give and the frequency with which it must be given, the beneficiary is always entitled to such information as is reasonably necessary to enable him to enforce his rights under the trust or to prevent or redress a breach of trust.

See Fletcher v. Feltcher, 480 S.E.2d 488 (Va. 1997). See generally Ruce, Philip J., "The Trustee and the Remainderman: The Trustee's Duty to Inform", 46(1) Real Property, Probate and Trust Law Journal (August 8, 2011). Available at SSRN: https://ssrn.com/abstract=1906650

The Restatements purport to summarize the majority common law rule in the U.S., although sometimes, for consistency of the analytical framework they instead present the "better rule" which there are conflicting rules in the case law.

Louisiana, because it has a civil law basis for its laws that originally didn't have the concept of a trust at all, and because it is often divergent in trust and estates matter, would be among those most likely to have a different rule. South Dakota and Nevada are also fairly likely to have a different rule, as their trust laws were designed to have a particular emphasis on privacy.

- 257,510

- 16

- 506

- 896