I've opened PayPal account for my business and in My Profile I've clearly selected the UK address. My phone is UK, my bank accounts are UK and the balance is shown in GBP. So this is very clear to PayPal that my account is UK based.

However I've received the following e-mail which says:

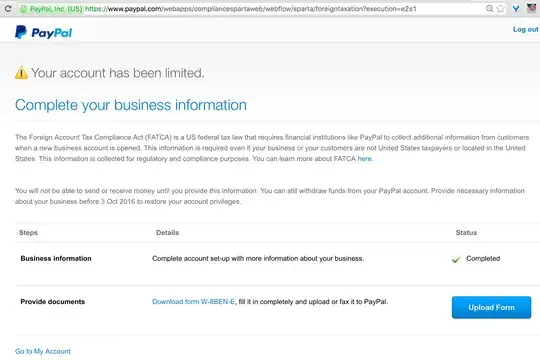

Your account access will remain limited until you add more information about your business.

Why do I need to add this information?

The Foreign Account Tax Compliance Act (FATCA), a U.S. tax law, requires financial institutions like PayPal to collect additional information from customers when a new business account is opened. You need to add this information even if your business or your customers are not United States taxpayers or located in the United States. We collect this information for regulatory and compliance purposes.

By adding "more information" they mean to download U.S. form W-8BEN-E, fill it in completely and upload or fax it to PayPal, however I don't want to fill some U.S. form, simply because I'm not from the U.S and I don't want to share my confidential personal details with the foreign country. To clarify, my business doesn't have any clients from the US and my business is registered in the UK. And as an owner of the business I've never been to the U.S.

So my question is, why am I affected by a U.S. tax law? Do I really need to comply with U.S. tax law (having the business in the UK)?

The above quote from the e-mail says that I need to add this information even though my business isn't located in the U.S. However on the FATCA FAQ page (requires log-in) it says:

For accounts held outside the United States that belong to non-US persons, financial institutions such as PayPal must gather information from account holders providing that they are not US persons.

For me this is contradictory to the previous quote (because here they ask me to prove I'm not a U.S. person) so I'm confused as to what I should do.

In other words, can my UK business somehow ignore FATCA requirements or not? Currently I'm forced to comply to the country compliance act tax (by filling W-8BEN-E) where I've nothing to do with it, which doesn't make any sense.