This is a partial answer to the portions of the question not answered by others.

Strictly speaking customary insurance policy language and customary insurance company practices in enforcing their rights are not themselves, the law, and neither are common practices for dealing with vehicles damaged in traffic accidents. But, these customs and practices are pervasive, are not too different among common law countries (except New Zealand, which is quite different), and are really necessary to understand to make sense of how the law applies to them. In general, the circumstances involved in the crash and the driver-owner/employee relationship, and the insurance policy are assumed to be typical, but there could always be weird outlier cases.

What happens to the vehicle?

This is a photoshop of a humanized cartoonish lorry, not a real one.

It is usually totaled (assuming a typical worst case scenario crash). It is towed to a scrap yard (at the employer-owner's expense). Then, it goes to lorry heaven. Its metal is crushed and sold for scrap. This makes the lorry very sad. Usually, the lorry's friends can't even attend a funeral for him. The cash from the sale of the scrap will be paid to the employer-owner and may reduce the amount that the employer-owner can get from insurance company.

Do insurance companies cover the damage?

Generally, the insurance company will cover the damage to the vehicle subject to the deductible that the owner of the vehicle loses out of pocket (unless the crash was intentional, such as a road rage or terrorist incident, in which case it isn't covered by insurance).

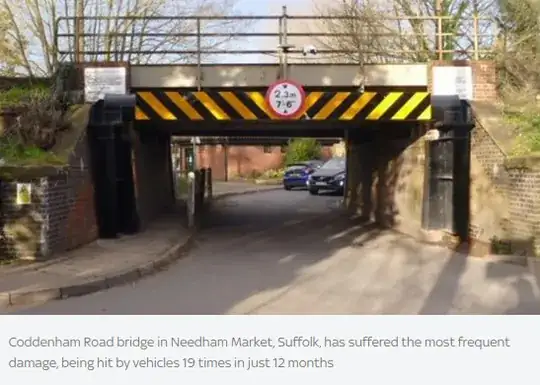

The insurance company will also cover the employer-owner's liability to third-parties for things like damage to the bridge (without a deductible) up to the policy limits of the insurance policy. The employer-owner has vicarious liability to anyone damages by the accident as a result of the negligence of their driver, and Bridge bashing is almost always negligent (assuming that it isn't intentional).

The insurance company will also usually pay for the lawyers to deal with the situation for the employer-owner. This makes the lawyer look like this:

Disclaimer: Some lawyers have a better attitude and are relentlessly cheerful.

See, e.g., here discussing typical coverages in an insurance policy covering a commercial vehicle in the U.K. (which owners are required by law to have in force).

The insurance company will have a subrogation claim against the driver for negligence for the amount it had to pay on the claim, if the insurance policy doesn't include a "waiver of subrogation" clause. (See generally, e.g., here, discussing insurance subrogation claims in the U.K.). Keep in mind also that the driver is probably not the insured, or at least, not the primary insured typically the insured would be the employer-owner and that would be the part who has suffered the loss and who is most likely to be sued for damage caused to others if the case is not settled by the insurance company.

But the insurance company will only pursue this subrogation claim if the driver has enough collectible assets to justify bringing the lawsuit against the driver.

Often, however, the driver (who is often a novice who only recently joined the work force because experienced drivers rarely make this mistake) has no assets of any value, has lost his job, and has lost his career as a truck driver since his license was revoked, so the driver isn't worth suing.

A typical British bridge basher after the accident.

The insurance rates paid by the employer-owner will probably also go up for a while as well, based upon its claim history.

I am a U.S. based attorney who has represented by insurance companies, and victims of truck hits structure accidents, and have first hand knowledge of that, but as the links above indicate, liability and insurance for accidents causing property damage in the U.K. is quite similar to insurance for accidents in other common law countries including the U.S. which derive their laws on the subject from U.K. law.

The main exception in the common law world is New Zealand which has a comprehensive government run no-fault insurance regime for many kinds harms arising from almost all accidents.