There are many relationships that cannot be described by a "static function" in N dimensions because relationships of the type I am talking about have an iterative element when one of the inputs of a function is its previous output.

Here is a specific toy example of an observation series where

I use this well-known formula for calculating the investment sum at the end of several periods:

f(x) = s*(1+i)^x

s = starting sum

i = interest

X (variable) = number of periods.

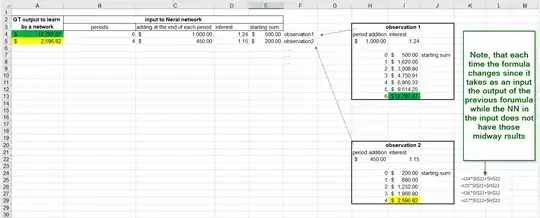

BUT In this specific sub-case I calculate the final sum at the end of several periods with the addition of some fixed sum of money at the end of each period, in such case, the formula above doesn't work "as is" it has to become iterative taking as an input own output from the previous iteration. see image attached:

Thus I wonder whether in such case a NN can find a dependency and predict similar cases as those in the two proposed observations of a training set. If yes, it is quite strange because after all a NN fits a curve to the input data points and this curve is actually a static function, but as seen from the Excel image in this case there is no "static function", since the function there is kinda recursive.